Which of the Following Fixed Assets Is Not Depreciated

2 See answers Advertisement Answer 50 5 0 megaharshavardhini Answer. B the fixed assets original cost equals its book value.

Property Plant And Equipment I Characteristics Of Fixed Assets

Which of the following foxed assets is not depreciated in the ordinary circumstances.

. Which of the following in NOT true when a fully depreciated fixed asset is retired. Full depreciation should be recorded and no loss recognized with an asset. Instead of depreciating such assets we amortize them which is quite similar to depreciation.

Which of the following fixed asset accounts is not depreciated. Therefore the costs of those assets must be allocated to those limited accounting periods. The book value of the store equipment on December 31 is.

Which one of the following tangible fixed assets would not normally be depreciated Buildings Machinery Land Equipment Land would not normally be depreciated. Salvage value is also known as scrap value. Land for site use Nash Co.

Which of the following fixed asset is not depreciated in ordinary circumstances. Salvage Value Salvage value is the estimated amount that an asset is worth at the end of its useful life. Standard Corporation is investing 400000 of fixed capital in a project that will be depreciated straight-line to zero over its 10-year life.

Other long-lived assets such as land improvements buildings furnishings equipment etc. A Plant Machinery B Building account C Land D Equipments ANSWER EXPLANATION Correct Answer. Value of land can not be reduced to zero and it can not be allocated over its useful life.

The store equipment depreciated 500 in December. Which one of the following tangible fixed assets would not normally be depreciated. Option C Solution By Examveda Team Land foxed assets is not depreciated in the ordinary circumstances.

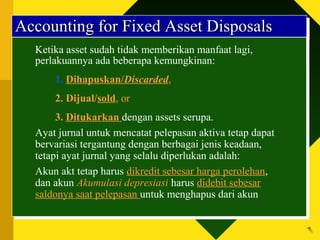

In regard to discarding fixed assets which of the following is not true. The cash receipt is recorded. But because there are separate accounting rules to.

An investment of 40000 in net working capital is required over the projects life. See the answer See the answer done loading. Land is not depreciated since it has an unlimited useful life.

Which of the following foxed assets is not depreciated in the ordinary circumstances. This message means that the system recognizes an asset that is not fully depreciated to the last day of the fiscal year. Equipment was purchased at a cost of 52000.

If the user account cannot be assigned the SUPER role ID you must verify that the user account has the following permissions. Land although a fixed asset is never depreciable. Depreciable assets include all tangible fixed assets of a business that can be seen and touched such as buildings machinery vehicles and equipment.

In addition low-cost purchases with a minimal useful life are charged to expense at once rather than being depreciated. A fully depreciated asset is an accounting term used to describe an asset that is worth the same as its salvage value. C the accumulated depreciation account is debited.

Have limited useful lives. It has an unlimited useful life and therefore can not be depreciated. If the selling price is more than the book value a gain is recorded.

Which of the following fixed assets is not depreciated. Current assets such as accounts receivable and inventory are not depreciated. Fixed Asset at cost The company would write off the fixed asset in the following circumstances.

Depreciation is allocation of cost of fixed asset over its useful life. Plant Machinery B. Which of the following fixed assets is not depreciated.

If all assets are not depreciated to the last day of the year depreciation may be overstated in the following year. Land is not depreciated since it has an unlimited useful life. 23102020 Math Secondary School answered Which one of the following tangible fixed assets would not normally be depreciated.

It has an unlimited useful life and therefore can not be depreciated. 76- Incurred but unpaid expenses that are recorded during the adjusting process with a debit to an expense and a credit to a liability are. 1 The company may write off the fixed asset if the assets are no longer in feasible use.

Land is not depreciated because land is assumed to have an unlimited useful life. An asset can become fully depreciated in two ways. Instead they are assumed to be converted to cash within a short period of time typically within one year.

Using the units-of-activity method to depreciate the copy machine how much will be depreciated if during the first year 550000 copies were made. 321 report that uses the Sumário layout in the Portuguese version of Microsoft Dynamics NAV 50 Service Pack 1. Which of the following fixed assets is not depreciated.

Assuming the equipment was sold at the end of Year 6 for 14000 which of the following will be included in the journal entry. C Land Land foxed assets is not depreciated in the ordinary circumstances. Which one of the following tangible fixed assets would not normally be depreciated.

Land although a fixed asset is never depreciable. Which of the following plant assets is not depreciated. It had an estimated useful life of seven years and a residual value of 3000.

A the asset account is credited. Note This behavior may also occur if an asset has a depreciation method of No Depreciation. The journal entry is similar to discarding fixed assets.

In accounting we do not depreciate intangible assets such as software and patents. Annual sales are expected to be 240000 and annual cash operating expenses are expected to be 110000. AEquipment bBuilding cMachinery dLand.

The fully depreciated fixed assets do not appear in separate lines on the FA Mod. Reported a net income for the current year of 120 000 cash flow operating activities of 150 000. Please scroll down to see the correct answer and.

See Page 1 75- Which of the following assets is not depreciated.

Fixed Assets Basics In Accounting Double Entry Bookkeeping

Journal Entry For Disposal Of Assets Not Fully Depreciated Fixed Asset Journal Entries Asset

No comments for "Which of the Following Fixed Assets Is Not Depreciated"

Post a Comment